Become a Client

Make your money work as hard as you do

Who we help

Financial planning is far from a one-size-fits-all situation, so we want to make sure we're the right fit to help. We only work with executives who:

Have total compensation of $250K or more

Are facing complexity with their finances

Are comfortable delegating their financial management

Want a trusted partner to serve as their personal CFO

How It Works

We like to keep things simple. So our process is as straightforward as we are.

Step 1

Ignition – Introductory Call

Demands for your time never stop so we know for you to carve out time to meet with us something in your life has reached a tipping point. We dive right in with a 45-minute call dedicated to understanding your most pressing concerns, what specific event or circumstance triggered you to reach out to us, and how we may be able to help.STEP 2

Think about it

We detest high-pressure sales. So at the end of our meeting, we simply suggest you reflect on our discussion and if we’re a fit, let us know when you are ready to begin. This is a partnership, so we want to be sure you are comfortable and committed day one.

The partner you’ve been looking for

Let us help make your financial decisions clear, simple and intentional

Looking for more information

before you get started?

- We are 100% independent - we are not beholden to any corporate overlord telling us what product quotas or services we have to push on any given day. All of our recommendations are based on our in-depth research and analysis of YOUR specific needs, not big brother’s balance sheet.

- We are woman owned – as one of the few women financial advisors worldwide and an even smaller number of women owned firms, we are proud to be part of an elite group.

- We are fiduciaries – We place your interests above our own. A badge we wear gladly as a matter of integrity and daily practice for us. It’s not just something we say, it’s what we do.

- We were you once – We WERE high level executives in corporate America, so we understand the demands for your time and attention.

- We take planning seriously – unlike many firms that provide planning as a ‘sticky’ element to try to keep clients or create a case to sell specific products, we LEAD with planning. We feel strongly that the advice we give provides more value than any product ever could. You will never see us push a product or investment returns as the holy grail.

- We’re tech nerds – with a background in technology prior to entering finance, you will find we EMBRACE technology as a way to improve our ability to connect and solve for our clients.

In many cases, YES we can. We have invested in technology that allows us to view, access and directly place trades at many employer plan or other outside custodians in a secure way. Not only does this improve our visibility and advice with more complete information, it saves you the hassle of forwarding us documents or placing trades yourself.

Unfortunately, no. We have found in our over 20 years that our clients get the most impact when we are fully informed of all aspects of their financial lives. When we are only seeing the investment piece, key information can be overlooked or decisions are made in other areas of your life that can lead to unpleasant tax consequences or missed opportunities. We simply can’t manage something we know nothing about! For this reason, we are no longer accepting any clients seeking investment management only.

- Example: A client tells us their income will be low enough to qualify to make a contribution to their Roth IRA. We accept the contribution and invest the funds. At tax time, the client realizes they forgot to account for stock RSU vesting resulting in their income exceeding the Roth contribution threshold requiring them to withdrawal the contribution and pay a tax penalty. Had we had a full picture of the client’s tax and income, we would have advised doing a Backdoor Roth Contribution, making the contribution in a way that was both compliant and avoided any tax penalties.

We serve clients throughout the country. Our services and technology have been carefully structured so that we can easily work together from any location.

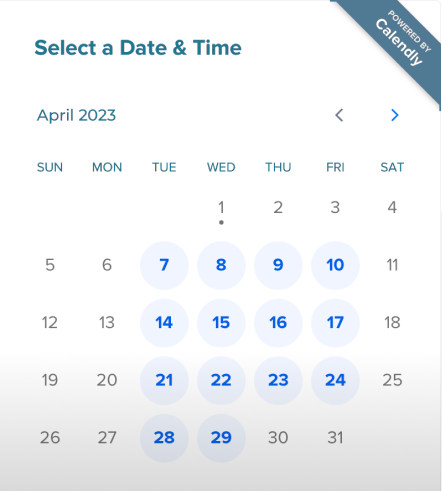

COVID changed how many companies work, especially with regard to how they conduct meetings. We’re no different. Following COVID, we opted to close our beautiful office and have embraced the shift to working remote. Today our meetings are 100% remote and conducted via Zoom, Teams or phone. We have embraced technology such as texting, online appointment scheduling, and screensharing to make connecting with us seamless and productive.

Great question. It's important you're able to determine our compatibility from the outset, so we do our best to be totally transparent with you about our approach. You would be a good fit for Ignite Financial if:

- You’re interested in a long-term partnership with a proactive team dedicated to helping you organize your financial life and keep it that way.

- You’re looking for a partner to help you see what the future might look like based on what you have in place today and willing to accept feedback on what changes could make things even better.

- You’re willing to let go of the idea of market timing and chasing returns. It just doesn’t work, so we follow a disciplined investment process to save our clients from making incredibly costly mistakes.

- You welcome the idea of delegating the day-to-day management of your financial life so you are free to focus on other things.

- You value advice from professionals and recognize that value comes at a cost.

Anyone can use the title “financial planner,” but only those who have fulfilled the certification requirements of the CFP Board and demonstrating a high level of competency, ethics and professionalism can display the CFP® certification trademarks. A CFP® Professional has specialized technical expertise with regards to retirement, estate, tax and investment planning; but the real skill comes in the ability to bring all those pieces of a person’s financial life together. And because they are held to a fiduciary standard of care when providing financial planning services, a CFP® professional is required to act in your best interest.

We believe in a simple, but sophisticated and disciplined approach to managing our clients’ investments. In order to do this, we've created an evidence-based approach to the steps in our investment management process; including – goals-based risk assessment, strategic asset allocation, manager selection and rebalancing. Most importantly, we do NOT try to time the market.

Because we focus on planning first, we also know where you can ‘afford’ to take more risk while ensuring your needs for short-term cash and long-term results remain in balance. We hit the gas where possible while keeping our foot on the brake elsewhere, keeping an even, controlled speed across your entire portfolio.